A reverse mortgage can be a powerful financial tool for homeowners 55 and older, offering the freedom to access the equity in your home without the need to sell or move.

At Homeguard Funding Ltd., we provide clear guidance to help you understand how reverse mortgages work, what options are available, and how they can support your retirement goals. With our expertise, you can make informed decisions that give you flexibility, security, and peace of mind in your retirement years.

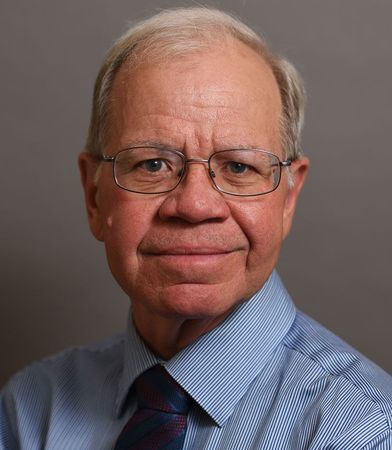

Hi, my name is Richard Mewhinney and I am both a Certified Reverse Mortgage Specialist, and a Mortgage Broker with Homeguard Funding Ltd. While I assist all types of mortgage clients, a significant number of my clients are Reverse Mortgage clients.

I work with all providers of Reverse Mortgages in Canada and carefully monitor new options in this category to ensure my clients understand all the options available to them.

I bring a unique understanding of the challenges those of us over 55 face, in some cases, I may have even been there myself, asking the same questions.

My objective is to provide my Reverse Mortgage clients with the freedom to ask any questions in a no pressure but informative conversation, giving you the time you need to make the decision you feel most comfortable.

If you want your Power of Attorney, Children or trusted friends included in our conversations to understand Reverse Mortgage options, I am more than happy to accommodate a meeting in a way that makes sense for you.

To help support the need for education, I have recorded a series of videos covering different topics pertaining to Reverse Mortgage that you can access for free. These videos are available for you to view at your leisure or share with your family.

If you want to contact me directly, please connect with me by creating a message on this page and I will get back to you usually within 24 hours or give me a call.

Please feel comfortable contacting me directly. I welcome your call, email, or questions in the below ASK RICHARD question box.

Richard Mewhinney was a wonderful and knowledgeable person regarding Reverse Mortgages. He answered all my questions in a polite and comforting way. He explained everything so that I knew what I was doing and felt safe with his expertise.

He was there when I had follow-up questions and when the deal went through. While we were going through the process with the lenders, he explained everything they asked to me before I had to answer.

I would completely recommend him to anyone who needs a Reverse Mortgage and a good person on their side.

LL

Help kids in the purchase of there first home

First time buyers are having a challenge in the current market. Many parents and Grandparents have decided to gift money to the kids to help with the Down payment but, where does the money come from? RRSP or RRIF both have tax implications when you withdraw and cashing other investments incur tax and you lose growth. A Reverse Mortgage allows for access to equity tax free while preserving investments for growth and future requirements.

Stress Free home ownership

Many seniors find themselves asset rich and cash poor limiting their ability to pay all the bills, look after home maintenance or do the things they want. A Reverse Mortgage can allow for the release of equity perhaps paying a supplement every month or using other controlled withdrawal options to access the funds when needed to look after all that is required to provide the security you’re looking for.

Live the life the way you want

You have the cash you need to take care of the home and you’re not looking to move away from family and friends but, while you’re able to comfortably look after the essentials you want the freedom to live your life the way you planned. A Reverse Mortgage may be the answer giving you the ability to draw what you want when you want for that special annual trip you always dreamed of or the ability to treat yourself or your partner to a special celebration. Tax free access to funds does exist to help you live the life you want.

Reverse Mortgage Video Series

The videos below will provide answers to questions about Reverse Mortgages and the ways they can assist you to accomplish your retirement goals.

01 Introduction & Overview of Reverse Mortgages

02 Myths and Misunderstandings about Reverse Mortgages

03 Who Provides Reverse Mortgages

04 What can I use a Reverse Mortgage

05 How do I qualify and how Much can I get

06 Reverse Mortgage Flexibility

07 What happens when I sell my property